You’ve heard it said before – qualitative research gives you the “Why?” and quantitative gives you the “How much?” However, qualitative research also delivers so much more than simply the “why” of consumer behavior:

- Voice of the Customer. Qualitative research shines when you need to hear how customers talk about your products and services. You may be trying to isolate what factors customers use to make decisions to purchase and then evaluate their satisfaction. Alternatively, you may need to figure out what language customers use when they discuss your brand, your products/services, and the experience they have had with your employees. In any event, qualitative research excels at helping you get close to your customer.

- Dig Deeper. Quantitative research techniques include open-end questions, but market researchers agree that most consumers don’t take the time or make effort to enter their deeply held feelings and beliefs in surveys. Even if you have a live interviewer in-person or on the telephone, the nature of the question and response format discourages the contemplative thoughtfulness that a good moderator can elicit in a qualitative research setting. Qualitative research allows respondents the time to think deeply about their perceptions, their beliefs, and the reasons for their behavior.

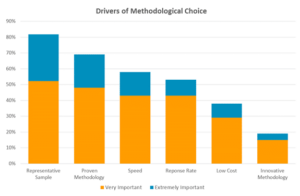

- Before and After. When paired with quantitative research, qualitative research can help improve the survey instrument, as well as increase the value of the quantitative results. Before the survey is designed, qualitative research can help inform the quantitative research by increasing the researcher’s understanding of how the product/service is used, by whom, and to accomplish what goals. Additionally, identifying the appropriate metrics or scales for questions can ensure better data is collected. After the quantitative research is over, qualitative research can help the researcher better understand the data through the customer’s explanation of their responses.

- Innovation and Improvement. Qualitative research can help marketers explore new products and innovations by working with consumers to identify unmet needs and dissatisfaction with current solutions. After all, you can’t ask what you don’t know to ask! Using qualitative techniques such as focus groups or ethnography is often very helpful in developing new products and new marketing programs.

BUILD YOUR BRAND WITH QUALITATIVE RESEARCH

In the words of Seth Godin, author of Purple Cow and Linchpin, “A brand is the set of expectations, memories, stories and relationships that, taken together, account for a consumer’s decision to choose one product or service over another. If the consumer (whether it’s a business, a buyer, a voter or a donor) doesn’t pay a premium, make a selection, or spread the word, then no brand value exists for that consumer.”

To build your brand, you must understand what your customer thinks about you. You must go beyond measuring awareness and familiarity and how much your brand is associated with certain attributes. You need to tap into the deep, emotional relationship that your customers, especially your most loyal customers, have with your brand. While it is interesting, and perhaps important, to understand the metrics of your brand, the real power comes from understanding consumers’ emotional attachment to your brand.

Qualitative research can be used in many ways to uncover information to strengthen brands:

- Establish Your Unique Brand Position. Your brand has more competition than ever. Regardless of your product or service, it is likely that your customers have multiple options from which to choose. This makes differentiating your brand from the competition essential to building loyalty and expanding your market influence. Qualitative market research offers ways to discover what your target market finds valuable about your brand or service and how that is different from and better than your competitors.

- Define Customer and Brand Values and Voice. Establishing a set of core values and definitions is often included as part of a business plan. So, it is likely that your brand has already defined its value, quality, and integrity. However, are you sure that your core values and definitions reflect those of your audience? Through qualitative market research, you can determine how your market determines value, quality, and other key terms and align your products and services accordingly.

- Find Brand Weaknesses with Qualitative Research. If your brand is suffering or just not competing as well as you would like, you might try some qualitative research to understand why. Is it your service? Has your product quality slipped recently? Do you just need to communicate better or differently? Qualitative research can help to highlight brand weaknesses, as well as identify ways to improve brand performance and defend your brand from the competition.

Whether it is focus groups, ethnography, or in-depth interviews, qualitative research allows marketers better to understand consumer relationships with their brand, as well as competitive brands. In this way, marketers can develop communications and branded experiences to strengthen competitive differentiation and build brand loyalty.

KEEP CUSTOMER SATISFACTION HIGH WITH QUALITATIVE RESEARCH

Satisfied customers are the growth engine that delivers so many benefits, including:

- More repeat purchases

- More recommendations to other purchasers

- More word of mouth advertising

- A willingness to pay premium prices and ignore competitive offers

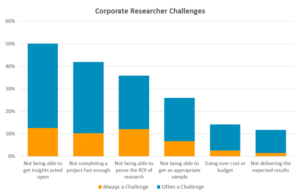

However, improving customer satisfaction takes more than just measuring satisfaction and calculating your Net Promoter Score. You have to understand what satisfies customers and why – and that only comes through qualitative research. If 30% of your customers are very satisfied, and 30% are just satisfied, is that good or bad? More importantly, what should you do about it? Is it smarter to try to address those who showed dissatisfaction, or to try to knock the socks off those who are merely satisfied?

Qualitative research can help answer those questions. By gaining a better understanding of the customer satisfaction dynamics of your market, your business, and your brand, you can find the low-hanging fruit to address immediately. Then you can design longer term initiatives to address the more difficult challenges.

Address Dissatisfaction

Asking follow-up open-end questions to get at the reasons why respondents rated themselves as dissatisfied with your product or service is a start, but often it will not give you the whole story. If respondents say the reason for their dissatisfaction is “pricing”, what do you do about that? The solution might not be decreasing prices; there might be payment plans that are needed, bundled pricing that could address the problem, or even volume pricing that could fit the situation. Without conducting the follow-on qualitative research, you could be leaving money on the table.

Customer dissatisfaction isn’t always about pricing. What if they tell you your customer service representatives are rude and unprofessional? Does that mean you need better training, or to change your hiring practices? Alternatively, perhaps it means the respondent doesn’t like the answers they are getting from Customer Service, and you need to look at your policies?

In almost any customer satisfaction survey, open-end responses are insufficient to pinpoint the problem and the appropriate solutions.

Define Exemplary Service

Often, it is more efficient to move the customer satisfaction needle by raising the merely “satisfied” respondents into the “very satisfied” category. However, what is not easy is determining what makes up exemplary service. Qualitative research can help you understand what actions would raise your customer’s experience to delightful. Don’t assume that you know what is needed to create raving fans; sometimes delivering more consistently through small changes in standards and processes is all it takes to raise the bar.

Adding qualitative research to your customer satisfaction research program can drive business improvements that deliver more satisfied customers. The benefits of increased customer satisfaction are long-lasting, creating a strong foundation for business growth and success. As Bill Gates said, “Your most unhappy clients are your greatest source of learning.”

BEAT THE ODDS: NEW PRODUCT SUCCESS WITH QUALITATIVE RESEARCH

Did you know that:

- 80% of all new product launches fail?

- 75% of CPG new product introductions fail?

- Less than 3% of CPG new product launches earn more than $50 million in their first year?

The odds of new product success stories are certainly not good. But they can be improved by understanding the reasons why products fail. Copernicus Marketing identified ten reasons why the new product success rate is so shockingly low:

- Marketers assess the marketing climate inadequately

- The wrong group was targeted

- A weak positioning strategy was used

- A less than optimal “configuration” of attributes and benefits was selected

- A questionable pricing strategy was implemented

- The ad campaign generated an insufficient level of awareness

- Cannibalization depressed corporate profits

- Over-optimism about the marketing plan led to an unrealistic forecast

- Poor implementation of the marketing plan in the real world

- The new product was pronounced dead and buried too soon

Further, Harvard Business Review has identified five other flaws that doom new products:

- Flaw 1 – The Company can’t support fast growth.

- Flaw 2 – The product falls short of claims and gets bashed.

- Flaw 3 – The new item exists in “product limbo,” without significant differences to sway buyers.

- Flaw 4 – The product defines a new category and requires substantial consumer education—but doesn’t get it.

- Flaw 5 –The product is revolutionary, but there’s no market for it.

Clearly, there are many causes for new product failure. But many of them can be addressed or avoided by market research, especially qualitative research.

Identifying Problems that Need Solutions

One of the most important applications of qualitative research is in exploring how consumers currently purchase products and services, how they much they like these products and services, and how they would improve the products and services they are using. Consumers are notoriously poor product designers (and hence Henry Ford’s statement about the automobile, “If I had asked them what they wanted, they would have said a faster horse”). However, they excel at telling you how a product or service works for them and with or against their lifestyle. Focus groups, in-home or on-site tests, and in-depth interviews are all excellent techniques for learning what consumers like – and don’t like – about using your product or service.

Observation

Ethnography, or research designed to observe the behavior of consumers, is a very powerful tool. Observing the consumer planning and preparing to use, using, and then evaluating the use of a product or service can help you identify ways to improve your products or come up with completely new products.

Successful new product development requires a disciplined process and the courage to say “no” to weak concepts. However, without a good understanding of consumers’ needs and desires, new product developers can only guess at what will work. If you want to increase the odds of new product success, you need more information, and qualitative research is an important tool for delivering that information.

QUALITATIVE RESEARCH PROVIDES A FLEXIBLE PLATFORM FOR USABILITY TESTING

According to Wikipedia, usability testing is “measuring a human-made product’s capacity to meet its intended purpose.” While most people typically think first of websites, software, and technological products when they think about usability testing, just about any product or service could be tested to determine ease of use and whether consumers can use them to accomplish the intended tasks. You can employ usability testing to evaluate food products, packaging, customer service or ordering procedures, training and documentation effectiveness – in essence, any product or service where there is user interaction.

Usability testing often uses a combination of qualitative and quantitative techniques. While the sample is typically small, usability testing often involves recording whether a task is successfully completed by the user and these data are presented quantitatively. Usability testing is also interested in the quality of the experience, and collects information on the users’ emotional state, reaction to the process, and comparison to other similar products/services they have used.

Some of the reasons for conducting usability testing include:

- Ensuring seamless, intuitive interaction with the product/service

- Exposing usability problems before launching the product/service

- Testing alternative design concepts and comparing design approaches

- Challenging the design and marketing teams’ assumptions

- Comparing your product/service to competitive offerings

- Improving ease of use, documentation and learning

- Attempting to decrease the need for technical support

- Saving time and money

- Increasing sales

Typically, a usability study tries to replicate as closely as possible the setting in which the consumer will use the product or service being tested, and identifies several tasks or challenges for the user to accomplish. In addition to tracking whether they complete the task or not and how long it takes, usability testing can also document the typical step-by-step thought process of the consumer while completing the task. Patterns will emerge quickly, but individual variations will continue to appear and are important for developing the best possible product. After the tasks are completed, the moderator will discuss the experience with the respondents. The goals of this discussion are to evaluate the experience in comparison to other products and services used, in the context of how the respondent might plan to use the product, and to generally rate the product in terms of ease of use.

DEVELOP BETTER CONCEPTS WITH QUALITATIVE RESEARCH

Whether you’re coming up with a new brand or marketing campaign, introducing a new product or service, or modifying your current product or service models, getting customer reactions to your new concept is a key step in concept evaluation.

Concept evaluation starts with writing the concept so that consumers can tell you what they think about it. Do the work of thinking about and clearly defining your concept. After all, if you cannot clearly communicate what you want to do, you probably aren’t ready to put it in front of consumers for evaluation.

What makes a good concept statement? The best concept statements communicate the benefit of the new product/service or messaging to the consumer. Martha Guidry, the self-proclaimed Concept Queen and founder of The Rite Concept classifies benefits into four categories:

- Benefits drawn from brand equity or the heritage of the brand. Brand equity benefits can be delivered through the company’s experience (“the oldest” or “delivering quality service for over 50 years”) or leadership.

- Efficacy benefits are based in formula or service-based claims. These products and services deliver the benefit better than their competitors.

- Sensory experience benefits appeal to the consumers’ senses of sight, smell and touch. (A laundry detergent delivers a “fresh scent” or “blindingly bright whites” is delivering a sensory experience benefit.)

- Emotional benefits are based on the personal feelings of the consumer. (If you don’t buy jewelry gifts at the right store, the recipient will think you are not very savvy or don’t care enough about them.)

Sometimes it is difficult to define the end benefit. Keep in mind that the concept and the benefit are NOT the same. To make sure you get to the end benefit, just keep peeling the onion by asking “What’s the result of that?” and “What does my target consumer get out of that?” A dipping sauce for chicken is not the benefit. The benefit is preparing nutritious and delicious family meals quickly and easily. It is critical that your concept statement is built around the benefit your product or service delivers, so make sure you get that right first.

Once you have nailed the benefit, here are some additional tips for writing your concept statement:

- Keep it short and simple. Only one benefit per concept. Only one paragraph, with three or four short sentences that clearly describe the idea. People don’t read anything carefully in our post-digital society, so use bullet points, bold highlighting, or other tools to enhance readability.

- Make sure the concept sounds appealing. Especially if it is a food, be sure to include how it tastes, and who it appeals to.

- Match your concept to your target audience. If your concept is a convenience food, don’t test it with food snobs! Similarly, don’t focus on the aspects that might make a gourmand find the concept appealing. It just won’t work.

- Include Reasons to Believe (RTB). How are you going to deliver the benefit to your consumer? Give them enough RTBs to answer their questions, and make them confident that the concept is real. But not too many RTBs (no more than the three most compelling) and no self-promotion, please. For example, for a food concept targeted at working moms with children, the product is chicken dipping sauces, and the benefit is a quick, easy way to give more variety to serving chicken to your family. The RTBs might include that the sauces are brought to you from a brand you know and trust, available in your grocery store and have been “kid-tested.”

- Use consumer language. If consumers are unfamiliar with the language you use, they will reject the concept, even if they might have liked it if they could have understood what it was. Make sure you use language that is not industry or company jargon, that the “man on the street” (or at least those in your target audience), will understand.

- Be realistic. Include information to help consumers evaluate their interest in your concept and whether they might explore purchase. Price, timing, other requirements or commitments to owning and using the product or service should be included to increase the realism of the concept and help consumers accurately assess their potential response.

- Be bold; don’t sell too hard, and don’t be boring. While your concept needs to be realistic, you don’t want your research participants to fall asleep over it. Don’t forget to give it a little sizzle and excitement, but only if it will really deliver on those positives.

Focus groups and in-depth interviews (either online or in-person) are excellent tools for concept testing. Use qualitative research to determine:

- If consumers understand the concept (and if not, why not)

- To evaluate how appealing the concept is

- Their interest in purchasing

- What questions they have or what obstacles they see to purchasing

SUMMARY

Qualitative research provides input into the key functions of any successful business. But before you embark on your next qualitative research project, make sure you have the following:

- An experienced moderator or qualitative research consultant. Find the right partner to work with you to design and complete the project.

- The ability to recruit the right people into your project. This is essential for success because if you don’t have the right kind of person in your research, you will not get the information you need.

- The right setting and tools for your project. A professionally designed focus group facility will have spaces specifically designed to make your respondents comfortable and secure, your clients more collaborative and productive, and your moderator more effective.

When all three of these elements are in place, you know your qualitative research project will deliver the information and insights you need.

If you’re not using qualitative research as an integral part of your market research program, you should reconsider. Take advantage of the rich insight and deep emotional feedback you can only get from qualitative research techniques.