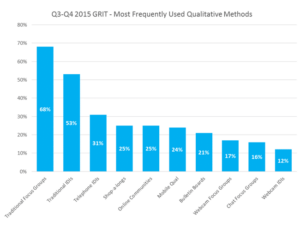

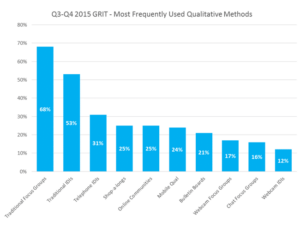

Recently, technology has given marketers many new and innovative ways to tap in the customer psyche and create a stronger, more visceral understanding of the marketplace. And while these new market research tools have great promise, none has yet taken the place of the traditional focus groups in delivering valuable insight. As shown in the 2015 Greenbook Research Industry Trends (GRIT) report, 79% of respondents reported using qualitative research in the previous year – and traditional focus groups maintain their position as the most used qualitative methodology. In total, 68% of 2015 GRIT respondents reported using traditional, face-to-face focus groups, up from 59% in 2014.

To be sure, periodically some “expert” declares focus groups dead – or at least dying – and advocates for their removal from the marketing research tool kit. And just as inevitably, marketers continue to ignore these so-called “experts” and use focus groups to develop stunning and exciting customer insights that deliver business success and profits.

The Internet, social media, digital technologies, video and graphics – all of these trends have changed the way we communicate and conduct business with each other. We now expect things to happen faster, more creatively and more efficiently than ever. And those expectations of speed, collaboration, creativity and flexibility are now requirements in all of our interactions with each other, personally as well as in our business and commercial interactions.

Not surprisingly, those changes in the way we need to interact with each other have also impacted the way marketers interact within their teams and how they expect to use information in managing brands, products and services. Ironically, the traditional focus group (or dyad or triad) is ideal at delivering the environment demanded by today’s marketers: offering greater speed, creativity, flexibility and collaboration than many other marketing research techniques.

COLLABORATIVE CREATIVITY

Great marketing is the art of making connections and building relationships – between products and customers, between services and customers, and between brands and customers. In the most natural sense, focus groups deliver the setting and inquiry that leads to the creation of and the understanding of these fundamental relationships.

Focus groups maximize all available brainpower (yours, the consumer’s and the moderator’s) by bringing it together in a tightly defined opportunity for discussion and brainstorming. While you may begin the focus group process with one objective, you can allow consumer insight be developed ad hoc by following the discussion and commentary in the group. Indeed, technology in focus groups has delivered new ways to stimulate consumer thinking and to advance the discussion agenda, such as usability testing and other kinds of collaborative tools for marking up communications and brainstorming new product features.

CUSTOMER INTIMACY

There is great power in watching a focus group. You look your customer in the eye, you see their body language, you get a strong sense of their emotions. You can watch them feel, touch, and use your products. You can watch their reactions to your carefully crafted messages. And when the focus group participants speak, they are speaking directly to you.

And that communication can go well beyond the marketing team. Product research and design, engineering, operations – no matter your role in product development and delivery, you cannot attend a focus group without hearing the voice of the customer. Focus group respondents pronounce judgments that influence the path and development of the product or service and impact its eventual success. And those product evaluations are all the more effective because of the intimate and personal nature of the focus group environment.

SPEED

All marketers continually fight the time challenge: you have less time to do the work, less time to launch the product, less time to prove the product works or not. Consumers today demand ever-changing and ever-evolving products and services. Many marketers simply do not have the time necessary for quantitative research. And they certainly don’t have the time necessary for quantitative research that might or might not deliver game-changing information.

Well-designed, well-recruited and well moderated focus groups can deliver key insights in a nanosecond. As one marketing manager told us, “You walk into the groups scratching your head, and you walk out with answers and direction.”

FLEXIBILITY

An obvious advantage to focus groups is that you do not get to the end of the project before you realize you’ve been asking the wrong questions. Because focus groups can take an iterative approach, the questions asked in the beginning define the questions to be asked later on in the groups. If you do not know the answer, you may not even know to ask the question. Focus groups give you the chance to define the question while you are getting the answer.

FOCUS GROUPS: A Perennial Favorite for Marketers

The stakes are high for marketers and market researchers alike these days. With increasing pressure on market research budgets, each project is required to provide critical insight for business success. The risk of non-delivery is high with many of the techniques available to market researchers, for the new and innovative techniques as well as for the “tried and true” techniques. And that is why focus groups continue to be so popular. As reported in Quirk’s 2015 Corporate Research Report, corporate purchasing of focus group facility and moderating services has held tight for nearly a decade, including during the 2008 economic downturn. Clearly, focus groups offer marketers an enduring value that supports their decision making.

Focus groups have many of the particular characteristics that marketers are looking for: They quickly deliver immediately useful insight and information. They are compelling and personal, producing results that drive change in behavior and direction. They are flexible and facilitate collaboration and creativity. In short, focus groups have the ability to ignite business success.

So, while they are not new or different, it is no wonder that focus groups remain a perennial favorite for marketers – and will continue as such for years to come.