Integrated Marketing: Getting Maximum Impact from your Marketing Tactics

By: Steve Henke, President & Founder of Harpeth Marketing

Imagine you work for a small-to-mid-size firm with a small – but active – marketing program. You have a solid website, you blog weekly, send out a monthly email blast, post to social media daily (LinkedIn and Twitter) and even produce a webinar once each quarter. Pretty good stuff!

But here’s the thing… if all of those tactics are not working together, you might not be achieving the kind of results you could be. For example…

- Blogging every week is a good thing… but if no one reads them, they have no real value. Are you using your email and social media to drive readers to your blog?

- Do your tweets link back to your website… or are you just spouting off random comments? Rule of thumb… 1 in 5 tweets link back to your website / 4 in 5 link to others’ content.

- Do you have links on your website and emails that connect visitors to your social media sites? Yes, use the little icons.

- When webinar participants register to attend, does their contact information automatically flow into your CRM… which then feeds future email blasts?

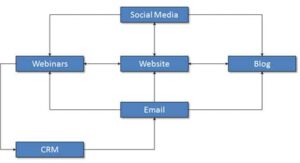

Everything working together is called Integrated Marketing. Take a look at what this integrated marketing eco-system might look like:

Now imagine what this little eco-system might look like when you add to it salespeople, networking, exhibiting at conferences, advertising, etc. Regardless of the complexity, it must be integrated. Everything must work in unison.

One final comment… every time a sales prospect is “touched” by one of your tactics, it registers in his or her conscience. And each additional touch adds to the ones before… helping you continually move upward, toward top-of-mind awareness with your prospects. But, if your tactics don’t have a consistent look and feel, then this ‘additive effect’ is lost. So, your website should look & feel like your print ads… should look & feel like your capabilities presentation… should look & feel like your trade show booth… should look & feel like your sales brochure… and so on.

Bottom line: As you build your marketing & sales program, remember to give some thought to how everything will work together. With integrated marketing, 1 + 1 really does = 3!

To learn more about how to get the most out of your marketing & sales tactics, download our FREE eBook, The Top 10 Tips for the Top 10 Marketing Tactics: 100 Killer Marketing & Sales Ideas at http://www.harpethmarketing.com/ebook/.

Abbe Macbeth, PhD is a Regional Sales Manager for Noldus Information Technology. Taking her expertise in Behavioral Neuroscience into scientific sales in 2010, Abbe set multiple company records for sales within the first two years. Quickly moving into a managerial role, she is now responsible for overseeing four sales regions and Noldus Consulting Services, US. Abbe is passionate about behavioral research in all forms, and delights in helping others find the perfect solution to meet their needs. Abbe holds a Bachlor’s degree in Cognitive Science, a Master’s degree in Psychology, and a PhD in Behavioral Neuroscience from City University of New York.

Abbe Macbeth, PhD is a Regional Sales Manager for Noldus Information Technology. Taking her expertise in Behavioral Neuroscience into scientific sales in 2010, Abbe set multiple company records for sales within the first two years. Quickly moving into a managerial role, she is now responsible for overseeing four sales regions and Noldus Consulting Services, US. Abbe is passionate about behavioral research in all forms, and delights in helping others find the perfect solution to meet their needs. Abbe holds a Bachlor’s degree in Cognitive Science, a Master’s degree in Psychology, and a PhD in Behavioral Neuroscience from City University of New York.

Brett Watkins

Brett Watkins

Jason received his doctorate in Psychology from the University of Utah. After a fellowship at MUSC in Charleston, SC, Jason joined Noldus in 2008. Jason also spent time with Nielsen Neurofocus and Brandtrust before returning to Noldus in 2013 as Product Expert and Lead Trainer.

Jason received his doctorate in Psychology from the University of Utah. After a fellowship at MUSC in Charleston, SC, Jason joined Noldus in 2008. Jason also spent time with Nielsen Neurofocus and Brandtrust before returning to Noldus in 2013 as Product Expert and Lead Trainer.

Rebecca Presler joined MLN Research in 2012 to plan, implement, and analyze qualitative research projects, especially those with children and teens. Rebecca cites the creative and surprising nature of research as the fuel to her qualitative fire. She is continual impressed by the depth and insights of the consumers with whom she speaks and the impact those understandings have for her clients and the business decision-making process.

Rebecca Presler joined MLN Research in 2012 to plan, implement, and analyze qualitative research projects, especially those with children and teens. Rebecca cites the creative and surprising nature of research as the fuel to her qualitative fire. She is continual impressed by the depth and insights of the consumers with whom she speaks and the impact those understandings have for her clients and the business decision-making process.